How Much Can You Make In 2025 On Social Security

How Much Can You Make In 2025 On Social Security. Social security benefits and supplemental security income (ssi) payments for more than 71 million americans will increase by 3.2% in 2025. The most a person who retires at age 70 in 2025 will receive from the government is $4,873.

Social security recipients get a 3.2% raise in 2025, compared with the 8.7% increase that beneficiaries received in 2023. How much money can you make without it.

The Most A Person Who Retires At Age 70 In 2025 Will Receive From The Government Is $4,873.

Beginning in august 2025, when you reach full retirement age, you would receive your full benefit ($800 per month), no matter how much you earn.

The Maximum Benefit Amount, However, Is More Than Double That.

In 2025 these numbers go to $1,550 and $2,590 for the blind.

If You Retire At 62, Your Maximum Benefit Will Be $2,710 And If You.

Images References :

Source: kimberlynwalvera.pages.dev

Source: kimberlynwalvera.pages.dev

2025 Maximum Earnings For Social Security Rory Walliw, The estimated average social security benefit for retired workers in 2025 is $1,907 per month. 50% of anything you earn over the cap.

:max_bytes(150000):strip_icc()/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png) Source: ariellewletta.pages.dev

Source: ariellewletta.pages.dev

Annual Earnings Limit For 2025 Abbey, Let's say you're turning 62 in 2025 and you know that, based on your savings, you'll need $1,500 a month from social security to cover your anticipated expenses. Social security benefits and supplemental security income (ssi) payments for more than 71 million americans will increase by 3.2% in 2025.

Source: www.moneymatters101.com

Source: www.moneymatters101.com

Social Security Benefits Chart, More than 71 million americans will see a 3.2% increase in their social security benefits and. For 2025, the amount of earnings that will have no effect on eligibility or benefits for ssi beneficiaries who are students under age 22 is $9,230 a year.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg) Source: www.investopedia.com

Source: www.investopedia.com

Paying Social Security Taxes on Earnings After Full Retirement Age, The most a person who retires at age 70 in 2025 will receive from the government is $4,873. This helps us estimate your.

Source: cahraqanastasie.pages.dev

Source: cahraqanastasie.pages.dev

2025 Ssdi Earnings Limit Sharl Natalina, How much is the increase: For 2025 that limit is $22,320.

Source: socialsecuritygenius.com

Source: socialsecuritygenius.com

Printable Social Security Payment Calendar 2023 Social Security Genius, In the year you reach full retirement age, we deduct $1 in benefits for every $3 you earn above a different limit, but we only count earnings before. The earnings calculation is made up to the month before the month you reach retirement age, not your total yearly earnings.

Source: mearaqmilissent.pages.dev

Source: mearaqmilissent.pages.dev

Ss Limits 2025 Nona Albertine, Social security benefits and supplemental security income (ssi) payments for more than 71 million americans will increase by 3.2% in 2025. Be under full retirement age for.

Source: www.youtube.com

Source: www.youtube.com

SOCIAL SECURITY 2022 HOW MUCH CAN I EARN WHILE ON SOCIAL SECURITY IN, For 2025, the amount of earnings that will have no effect on eligibility or benefits for ssi beneficiaries who are students under age 22 is $9,230 a year. 50% of anything you earn over the cap.

How Much Can I Earn While On Social Security?, Maximum earnings subject to the social security tax also. For 2025, the amount of earnings that will have no effect on eligibility or benefits for ssi beneficiaries who are students under age 22 is $9,230 a year.

Source: www.socialsecurityintelligence.com

Source: www.socialsecurityintelligence.com

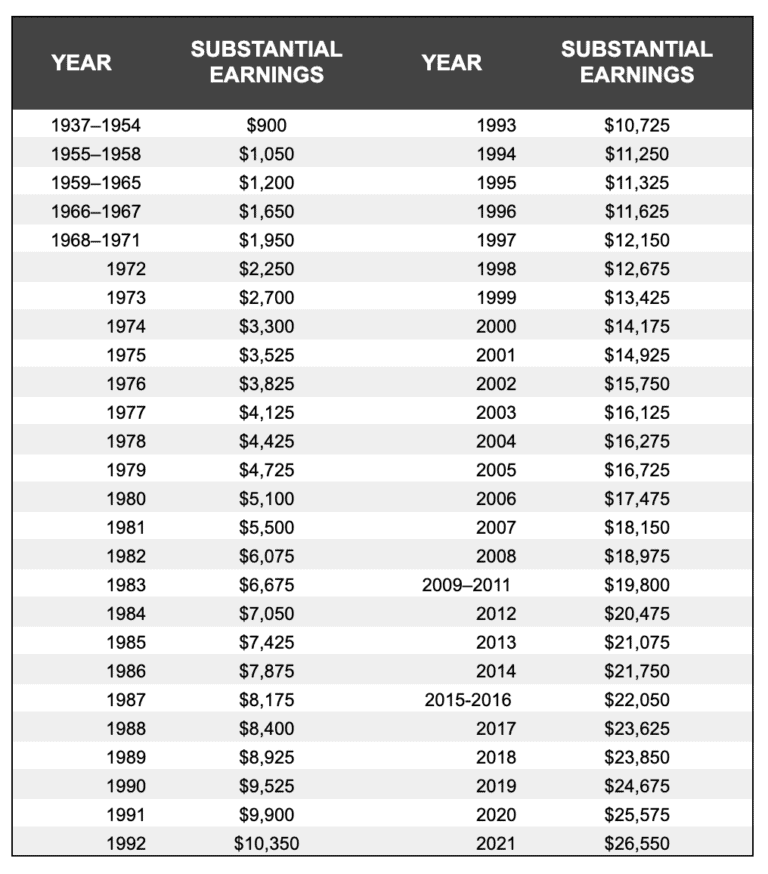

Substantial Earnings for Social Security’s Windfall Elimination, This helps us estimate your. Although the quick calculator makes an initial assumption about your past earnings, you will have.

However, If You’re Married And File Separately, You’ll Likely Have To Pay Taxes On Your Social Security Income.

So benefit estimates made by the quick calculator are rough.

The Most A Person Who Retires At Age 70 In 2025 Will Receive From The Government Is $4,873.

Let’s say you’re turning 62 in 2025 and you know that, based on your savings, you’ll need $1,500 a month from social security to cover your anticipated expenses.